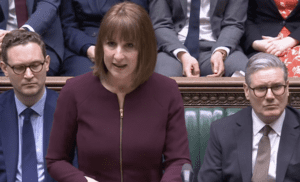

Chancellor Rachel Reeves is considering softening Labour’s flagship plans to scrap the non-domiciled tax regime, amid rising concern over the growing exodus of wealthy individuals and business leaders from the UK.

The Treasury is reportedly reassessing proposals to apply inheritance tax to the global estates of non-doms—UK residents who consider their permanent home to be abroad—after warnings that the measure could drive significant capital and talent out of the country. The changes, part of a wider overhaul of the centuries-old regime, are due to take effect in April 2025, but concerns are mounting that the new system is triggering a level of flight far beyond what had been forecast.

At the heart of the reconsideration is the government’s plan to charge inheritance tax at 40% on worldwide assets held by wealthy non-doms once they have lived in the UK long enough to become deemed domiciled under the new rules. The Treasury is now thought to be exploring revisions or exemptions to this aspect of the policy, in an effort to stem the tide of departures.

“There will most likely be some tweaks to inheritance tax to stop the non-dom exodus,” a senior City figure told the Financial Times.

The exodus of wealthy individuals is already visible in the data. Companies House filings analysed by Bloomberg show that more than 4,400 company directors have left the UK in the past year, with a particularly sharp rise over the past few months. In April alone, departures were 75% higher than the same month in 2023, with the greatest concentration in the finance, insurance and property sectors—fields long favoured by non-doms.

The exodus includes a growing list of high-profile names. Bloomberg has reported that figures such as billionaire heiress Anne Beaufour, investor Max Gottschalk, Magna Capital CEO Alexander Ginzburg, JC Flowers co-president Tim Hanford, and boxing promoter Eddie Hearn have recently left the UK. The steel magnate Lakshmi Mittal, whose family is worth nearly £15 billion and who has lived in Britain since 1995, is also reported to be considering relocation due to the new tax regime.

The Treasury has acknowledged the concerns, issuing a statement saying: “The government will continue to work with stakeholders to ensure the new regime is internationally competitive and continues to focus on attracting the best talent and investment to the UK.”

The original non-dom regime, in place for decades, allowed wealthy foreigners living in the UK to shield foreign income and assets from British taxation for an annual fee starting at £30,000. It was scrapped by Jeremy Hunt during his tenure as chancellor in March 2024, pre-empting Labour’s own pledge to end non-dom status.

Under the new residence-based tax regime, individuals who have been in the UK for more than four years will be taxed on worldwide income and capital gains, and after a longer period, on global estates for inheritance tax purposes. While the Office for Budget Responsibility (OBR) originally forecast that between 12% and 25% of non-doms would leave, a more recent Oxford Economics survey of tax advisers found that 60% expected over 40% of their non-dom clients to relocate within two years of the change.

Critics have argued that while Labour’s reform was intended to ensure fairness in the tax system, the loss of non-doms—and the high levels of capital, spending and business investment they bring—could ultimately result in lower tax receipts and damage to the UK’s competitiveness.

Non-doms often support a wide ecosystem of private employment, investment, and philanthropic activity. Their departure, some fear, may create a ripple effect, weakening everything from real estate investment to venture funding.

Rachel Reeves, who has pitched herself as a pro-business chancellor focused on growth, now faces a delicate political and economic balancing act. On the one hand, Labour’s plans to scrap the non-dom regime were central to its pre-election narrative of building a fairer tax system. On the other, the government is now under pressure to reassure international investors and avoid scaring away entrepreneurs, executives, and wealth creators.

Sources close to the Treasury have indicated that any softening of the policy would be focused specifically on mitigating the impact of inheritance tax—widely regarded as the most punitive element of the changes—while keeping the broader reform intact.

With Mittal, Beaufour, and others already exploring exit strategies, the government is expected to signal its intentions in the coming months, ahead of the policy’s implementation in April. Until then, advisers say the uncertainty alone is fuelling further departures, adding urgency to the debate over how far Labour is prepared to go to keep Britain attractive to global wealth.

Read more:

Rachel Reeves reconsiders non-dom tax changes to halt exodus of wealthy individuals